Fibonacci retracements are a technical indicator in financial analysis based on the mathematical concepts of Fibonacci numbers and ratios. This indicator is used to identify potential support and resistance levels in the price trend of an asset. Fibonacci numbers and ratios are used in many areas of technical analysis and are considered important tools for identifying trend reversals and placing stop-loss and take-profit orders.

How do Fibonacci retracements work?

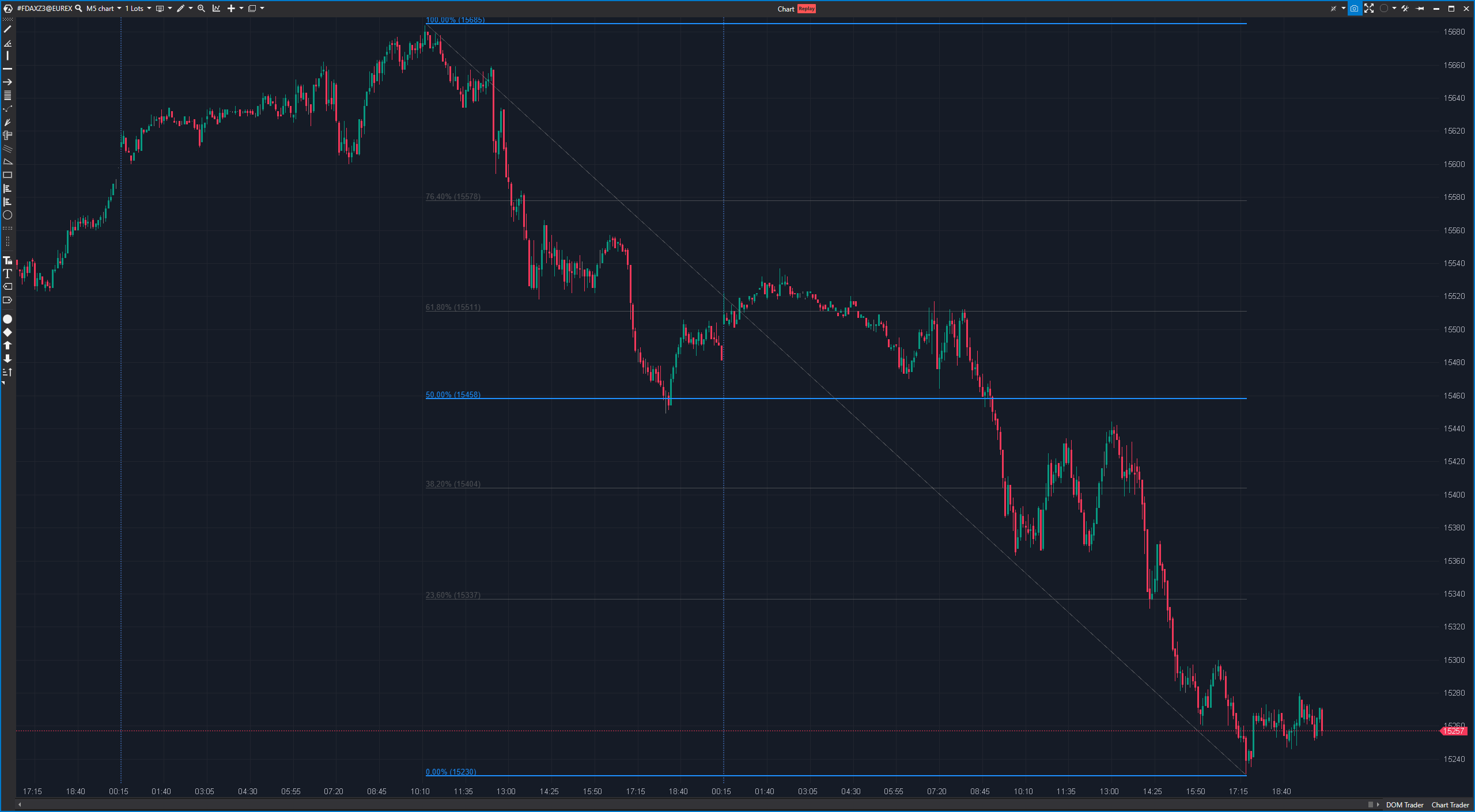

The Fibonacci retracements are displayed on a chart and use the most important Fibonacci ratios, including 23.6%, 38.2%, 50%, 61.8% and 100%. These levels are drawn from a low point (swing low) to a high point (swing high) in the price trend. The retracement levels represent potential support and resistance levels at which the price could correct or reverse after a move.

Advantages of Fibonacci retracements:

- Identification of support and resistance levels: Fibonacci retracements can help identify potential areas where price may find support or resistance. This can be useful when determining entry and exit points.

- Confirmation of trend reversals: If the price stops at one of the Fibonacci retracement levels and reverses, this may indicate a possible trend reversal.

- Simplicity: The use of Fibonacci retracements is simple and available on most charting platforms.

Disadvantages of Fibonacci retracements:

- Subjective interpretation: The selection of the relevant low and high points in the price trend can be subjective and produce different results.

- No guarantee of accuracy: Fibonacci retracements are not absolute price levels at which the market will necessarily reverse. These are potential areas that should be considered, but there is no guarantee that the price will behave in these areas.

Practical application of Fibonacci retracements:

An example of the practical application of Fibonacci retracements is the use of these levels to set stop-loss and take-profit levels:

- Setting stop-loss levels: A trader could place a stop-loss level slightly below a key Fibonacci retracement level to limit losses if the price moves in the opposite direction.

- Setting take profit levels: A trader could place a take profit level slightly before or at an important Fibonacci retracement level to realize profits if the price moves in the desired direction.

Fibonacci retracements can also be used in conjunction with other technical indicators and analysis techniques to make informed trading decisions. However, traders should bear in mind that this is a tool and should not be used as the sole indicator for trading decisions. It is important to consider market conditions, risk management and other factors in your trading strategy.